Avant-Garde Venues: Local Noise Music Performance Spaces

In the realm of underground music, avant-garde venues serve as vital spaces for the performance and appreciation of local noise music. These venues are characterized by their unconventional settings, experimental soundscapes, and a collective desire to challenge traditional notions of musicality. One such example is The Sonic Lab, a hypothetical venue located in a repurposed …

Sound Finance: Optimizing Local Noise Music for Financial Success

The world of noise music, characterized by its experimental and unconventional approach to sound production, has gained a significant following in recent years. While often perceived as a purely artistic endeavor, noise musicians are increasingly exploring the potential for financial success within this niche genre. This article aims to examine the concept of “Sound Finance” …

Collaborations Unveiled: Local Noise Music: Artist Profiles

Collaborations in the realm of local noise music have become increasingly prevalent, showcasing a diverse range of artists and their unique sonic explorations. This article aims to delve into the world of these collaborations, shedding light on the artist profiles that contribute to this vibrant scene. By analyzing one particular case study, we can gain …

Equipment in Local Noise Music: The Essential Gear

In the realm of experimental music, local noise scenes have gained considerable attention for their unconventional and boundary-pushing approaches to sound creation. Within these vibrant communities, a particular subset known as “noise music” has emerged as an intriguing genre that embraces dissonance, improvisation, and sonic exploration. As noise musicians strive to create captivating and immersive …

Equipment in Local Noise Music: The Essential Gear

In the realm of experimental music, local noise scenes have gained considerable attention for their unconventional and boundary-pushing approaches to sound creation. Within these vibrant communities, a particular subset known as “noise music” has emerged as an intriguing genre that embraces dissonance, improvisation, and sonic exploration. As noise musicians strive to create captivating and immersive …

Discography: Artist Profiles in Local Noise Music

In the realm of music, noise is often perceived as an aberration, a disruption to harmony and melody. However, there exists a subgenre known as local noise music that challenges traditional notions of musicality and embraces chaotic soundscapes. This article delves into the discography of various artists within this niche genre, aiming to provide insightful …

Tape Loops in Local Noise Music Techniques: Explained

Tape loops have long been a staple in the realm of local noise music techniques, serving as a versatile tool for sonic experimentation and manipulation. These self-contained snippets of recorded sound played repeatedly on looped tape create mesmerizing, repetitive patterns that can be further modified through various means. For instance, imagine a hypothetical scenario where …

Interviews: Local Noise Music Artist Profiles

In the realm of music, local noise artists often occupy a fascinating and enigmatic space. Their unconventional approach to sound creation challenges traditional notions of melody and structure, inviting listeners into an immersive sonic experience that pushes boundaries. This article aims to delve into the world of local noise music artist profiles through interviews, shedding …

Circuit Bending: Local Noise Music Techniques

Circuit bending, a technique rooted in the realm of local noise music, has gained significant attention among musicians and enthusiasts alike. This practice involves manipulating electronic devices such as keyboards or toy synthesizers to produce unconventional sounds and textures. One captivating example of circuit bending is the case study of musician X, who transformed an …

Correlation Between Local Noise Music and Property Value: The Impact on Sound Finance

The correlation between local noise music and property value has become an intriguing topic of investigation in recent years. This study aims to explore the impact of sound finance on neighborhood desirability, specifically focusing on how the presence of noise music venues may influence property values. By examining empirical evidence and employing statistical analysis techniques, …

Field Recordings in Local Noise Music: Techniques

Field recordings play a crucial role in the creation and exploration of local noise music. By capturing and manipulating sounds from various environments, artists are able to infuse their compositions with a distinct sense of place and context. This article delves into the techniques involved in utilizing field recordings within the realm of local noise …

Underground Spaces: Local Noise Music Performance Venues

In recent years, there has been a growing interest in alternative music scenes and the unique venues that host them. One such phenomenon is the emergence of underground spaces as local noise music performance venues. These hidden gems offer an intimate setting where musicians can experiment with unconventional sounds and create immersive experiences for their …

Avant-Garde Venues: Local Noise Music Performance Spaces

In the realm of underground music, avant-garde venues serve as vital spaces for the performance and appreciation of local noise music. These venues are characterized by their unconventional settings, experimental soundscapes, and a collective desire to challenge traditional notions of musicality. One such example is The Sonic Lab, a hypothetical venue located in a repurposed …

International Noise Music Collaborations in the Context of Local Noise Music: Noise Music Festivals

Noise music, characterized by its unconventional and abrasive soundscapes, has garnered a significant following across the globe. In recent years, international noise music collaborations have emerged as an intriguing phenomenon within the context of local noise music scenes. These collaborations involve artists from different countries coming together to create unique sonic experiences that transcend cultural …

Noise Generators in Local Noise Music: Equipment Overview

Noise generators are essential tools in the creation of local noise music, a genre characterized by its experimental and unconventional nature. These devices produce a wide range of unpredictable sounds that form the foundation of this unique musical style. In this article, we will provide an overview of various noise generators commonly used in the …

Generating Revenue: Local Noise Music Events in the Context of Sound Finance

Noise music events have gained significant attention in recent years, both as a form of artistic expression and as potential revenue generators. This article explores the concept of generating revenue through local noise music events within the context of sound finance. Drawing upon real-world examples and hypothetical scenarios alike, it examines the various strategies that …

Soundproofing Options for Local Venues: Enhancing Noise Control in Local Noise Music Scenes

Venues that host live music performances play a crucial role in fostering local music scenes and offering opportunities for artists to showcase their talents. However, the issue of noise control has become increasingly important as it can impact not only the quality of the performances but also the relationship between venues and their surrounding communities. …

Correlation Between Local Noise Music and Property Value: The Impact on Sound Finance

The correlation between local noise music and property value has become an intriguing topic of investigation in recent years. This study aims to explore the impact of sound finance on neighborhood desirability, specifically focusing on how the presence of noise music venues may influence property values. By examining empirical evidence and employing statistical analysis techniques, …

Soundproofing Options for Local Venues: Enhancing Noise Control in Local Noise Music Scenes

Venues that host live music performances play a crucial role in fostering local music scenes and offering opportunities for artists to showcase their talents. However, the issue of noise control has become increasingly important as it can impact not only the quality of the performances but also the relationship between venues and their surrounding communities. …

Techniques Unveiled: Local Noise Music Exploration

Local noise music exploration is a fascinating and avant-garde artistic movement that pushes the boundaries of sound experimentation. This article aims to delve into the techniques utilized by local noise musicians, shedding light on their innovative approaches and creative processes. By examining one hypothetical case study, we will explore how these artists manipulate sound sources, …

DIY Venues in Local Noise Music: An Informative Guide

In the realm of underground music scenes, noise music stands out as a genre that defies traditional musical conventions and embraces sonic experimentation. Within this subculture, DIY venues play a vital role in fostering creativity and providing platforms for artists to showcase their work. This article aims to provide an informative guide on DIY venues …

Contemporary Noise Music Artists: Local Noise Music and Festivals

Contemporary noise music artists have emerged as a significant force within the realm of experimental music, challenging conventional notions of musicality and pushing the boundaries of sonic exploration. This article focuses on local noise music scenes and festivals, examining their unique characteristics and contributions to the broader landscape of contemporary art. To illustrate these concepts, …

Impact of Local Noise Music on Sound Finance: The Effects of Noise Pollution on the Local Economy

The impact of local noise music on sound finance is a subject that has garnered increasing attention in recent years. As cities and urban areas continue to grow, so does the prevalence of noise pollution resulting from various sources, including live music performances. This article aims to explore the effects of such noise pollution on …

Granular Synthesis: Techniques for Local Noise Music

Granular synthesis is a versatile technique employed in the creation of local noise music. This article aims to explore and analyze various techniques utilized in granular synthesis for the production of compelling and immersive soundscapes. By breaking down audio samples into tiny, discrete fragments known as grains, granular synthesis allows composers and performers to manipulate …

Noise Generators in Local Noise Music: Equipment Overview

Noise generators are essential tools in the creation of local noise music, a genre characterized by its experimental and unconventional nature. These devices produce a wide range of unpredictable sounds that form the foundation of this unique musical style. In this article, we will provide an overview of various noise generators commonly used in the …

Local Noise Music: DIY Scene and Festivals

The local noise music scene and its associated festivals have gained significant attention in recent years due to their unique characteristics and grassroots approach. This article explores the do-it-yourself (DIY) ethos of this scene, highlighting its emphasis on artistic experimentation, community-building, and independent production. To illustrate these concepts, we will examine a hypothetical case study …

Local Noise Music: A Cultural Expression in the Context of Sound Finance

In the world of contemporary music, local noise music stands as a unique and intriguing cultural expression. Defined by its unconventional approach to sound production and composition, this genre challenges traditional notions of melody and rhythm. Through the exploration of dissonance, distortion, and experimental techniques, local noise artists create sonic landscapes that provoke intense emotional …

Experimental Music Venues: Local Noise Music Performance Spaces

Experimental music venues have emerged as unique and dynamic spaces that foster the exploration and appreciation of noise music. These unconventional performance spaces provide a platform for musicians to push the boundaries of traditional musical expression, challenging conventional notions of melody, harmony, and rhythm. In this article, we will delve into the world of experimental …

Performance Venues: Local Noise Music: An Informational Overview

Performance venues play a crucial role in the cultural landscape of any city, providing platforms for various artistic expressions. Among the diverse range of performances that take place within these spaces, noise music has emerged as an intriguing and unconventional genre. Defined by its experimental nature and emphasis on sonic textures, noise music challenges traditional …

Independent Performance Spaces: Local Noise Music Venues

Independent performance spaces, particularly those dedicated to noise music, have emerged as vibrant and essential components of local cultural scenes worldwide. These unique venues provide a platform for experimental artists and musicians who wish to push the boundaries of conventional sound and challenge traditional notions of musicality. Through showcasing unconventional genres such as noise music, …

Collaborations Unveiled: Local Noise Music: Artist Profiles

Collaborations in the realm of local noise music have become increasingly prevalent, showcasing a diverse range of artists and their unique sonic explorations. This article aims to delve into the world of these collaborations, shedding light on the artist profiles that contribute to this vibrant scene. By analyzing one particular case study, we can gain …

Local Noise Music: Live Performances and Artist Profiles

Local noise music scenes have been gaining momentum and attracting attention in recent years. This unique genre of music, characterized by its unconventional use of sound, has captivated audiences with its experimental nature and immersive live performances. One such example is the thriving noise music scene in the city of Portland, Oregon. Through a case …

Alternative Music Spaces: Local Noise Music Performance Venues

Alternative music spaces, often referred to as local noise music performance venues, have emerged as significant cultural phenomena in recent years. These unique spaces provide a platform for underground and experimental musicians to showcase their work to an audience seeking non-mainstream sounds and experiences. To illustrate the significance of these alternative music spaces, consider the …

Influences in Local Noise Music: Artist Profiles

In the realm of local noise music, artists are often influenced by a myriad of factors that shape their unique artistic vision and sonic expression. This article aims to explore these influences through an in-depth analysis of various artist profiles within the genre. By examining the diverse range of backgrounds, experiences, and musical preferences that …

Loop Stations: Essential Equipment for Local Noise Music

Local noise music has gained significant popularity in recent years, captivating audiences with its experimental soundscapes and unconventional approach to musical composition. At the forefront of this movement lies an essential piece of equipment known as loop stations. Loop stations provide musicians with the ability to create complex layers of sound by recording and playing …

International Noise Music Collaborations in the Context of Local Noise Music: Noise Music Festivals

Noise music, characterized by its unconventional and abrasive soundscapes, has garnered a significant following across the globe. In recent years, international noise music collaborations have emerged as an intriguing phenomenon within the context of local noise music scenes. These collaborations involve artists from different countries coming together to create unique sonic experiences that transcend cultural …

Techniques Unveiled: Local Noise Music Exploration

Local noise music exploration is a fascinating and avant-garde artistic movement that pushes the boundaries of sound experimentation. This article aims to delve into the techniques utilized by local noise musicians, shedding light on their innovative approaches and creative processes. By examining one hypothetical case study, we will explore how these artists manipulate sound sources, …

Discography: Artist Profiles in Local Noise Music

In the realm of music, noise is often perceived as an aberration, a disruption to harmony and melody. However, there exists a subgenre known as local noise music that challenges traditional notions of musicality and embraces chaotic soundscapes. This article delves into the discography of various artists within this niche genre, aiming to provide insightful …

Alternative Music Spaces: Local Noise Music Performance Venues

Alternative music spaces, often referred to as local noise music performance venues, have emerged as significant cultural phenomena in recent years. These unique spaces provide a platform for underground and experimental musicians to showcase their work to an audience seeking non-mainstream sounds and experiences. To illustrate the significance of these alternative music spaces, consider the …

The Impact of Local Noise Music on Tourism: The Relationship in the Context of Sound Finance

In recent years, the emergence and popularity of local noise music have sparked a growing interest among researchers and policy-makers in understanding its impact on tourism. This article examines the relationship between local noise music and tourism from the perspective of sound finance. With an increasing number of travelers seeking unique cultural experiences, destinations that …

Performance Venues: Local Noise Music: An Informational Overview

Performance venues play a crucial role in the cultural landscape of any city, providing platforms for various artistic expressions. Among the diverse range of performances that take place within these spaces, noise music has emerged as an intriguing and unconventional genre. Defined by its experimental nature and emphasis on sonic textures, noise music challenges traditional …

Glitch Techniques: Local Noise Music

The field of music production has seen the emergence of various experimental techniques that challenge conventional notions of sound composition and arrangement. One such technique is glitch, a genre that embraces imperfections and errors within digital audio to create unique sonic experiences. Glitch music utilizes local noise as its primary building block, manipulating and distorting …

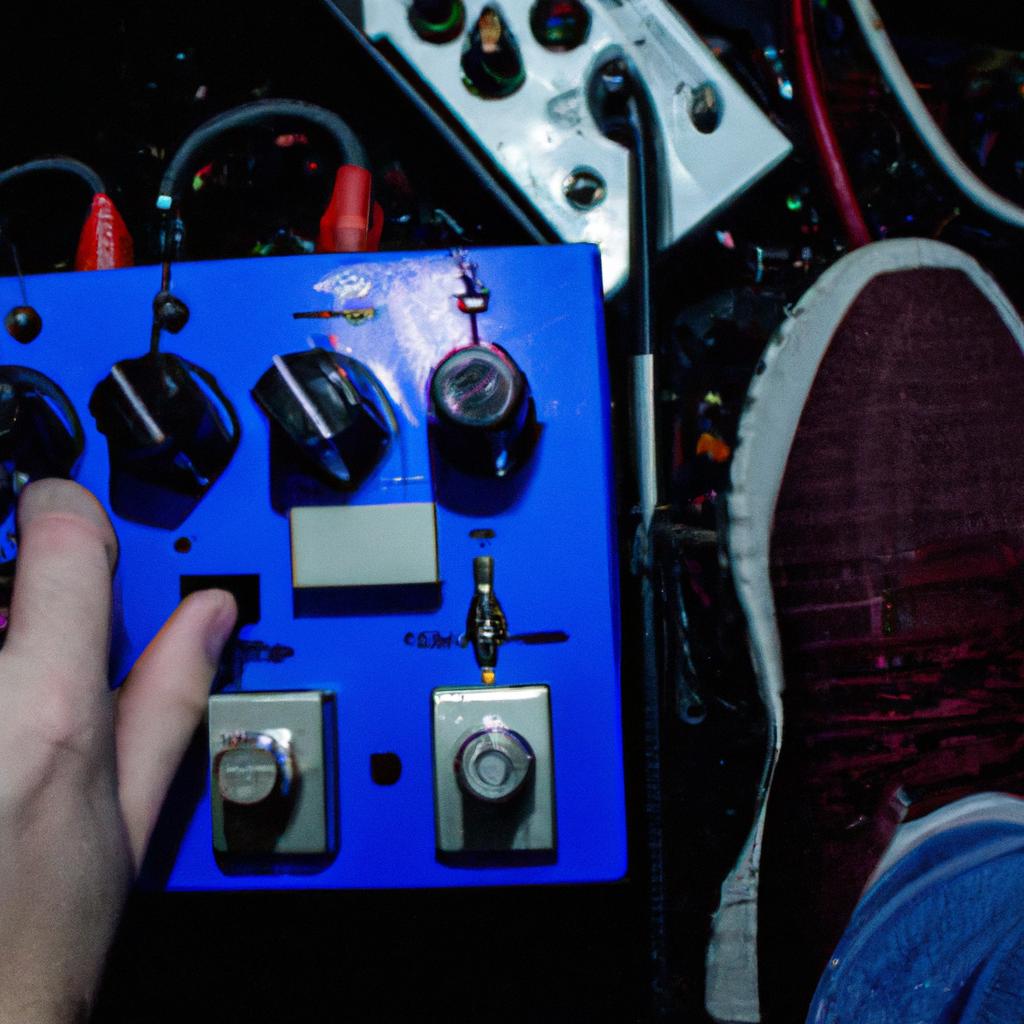

Effects Pedals: The Sonic Possibilities for Local Noise Music Equipment

Effects pedals have revolutionized the world of music, providing musicians with a plethora of sonic possibilities. These small devices are capable of transforming the sound produced by various musical instruments, allowing artists to create unique and experimental sounds. One such example is the case of a local noise musician who used effects pedals to enhance …

Underground Spaces: Local Noise Music Performance Venues

In recent years, there has been a growing interest in alternative music scenes and the unique venues that host them. One such phenomenon is the emergence of underground spaces as local noise music performance venues. These hidden gems offer an intimate setting where musicians can experiment with unconventional sounds and create immersive experiences for their …

Local Noise Music: A Cultural Expression in the Context of Sound Finance

In the world of contemporary music, local noise music stands as a unique and intriguing cultural expression. Defined by its unconventional approach to sound production and composition, this genre challenges traditional notions of melody and rhythm. Through the exploration of dissonance, distortion, and experimental techniques, local noise artists create sonic landscapes that provoke intense emotional …

Local Noise Music: DIY Scene and Festivals

The local noise music scene and its associated festivals have gained significant attention in recent years due to their unique characteristics and grassroots approach. This article explores the do-it-yourself (DIY) ethos of this scene, highlighting its emphasis on artistic experimentation, community-building, and independent production. To illustrate these concepts, we will examine a hypothetical case study …

Influences in Local Noise Music: Artist Profiles

In the realm of local noise music, artists are often influenced by a myriad of factors that shape their unique artistic vision and sonic expression. This article aims to explore these influences through an in-depth analysis of various artist profiles within the genre. By examining the diverse range of backgrounds, experiences, and musical preferences that …

Underground Noise Music Festivals: Local Noise Music

Underground noise music festivals have been gaining popularity in recent years, particularly within the realm of local noise music scenes. These unique events provide a platform for musicians and artists to showcase their avant-garde soundscapes while embracing unconventional approaches to musical expression. One notable example is the annual “Sonic Disruption” festival held in an abandoned …

Tape Loops in Local Noise Music Techniques: Explained

Tape loops have long been a staple in the realm of local noise music techniques, serving as a versatile tool for sonic experimentation and manipulation. These self-contained snippets of recorded sound played repeatedly on looped tape create mesmerizing, repetitive patterns that can be further modified through various means. For instance, imagine a hypothetical scenario where …

Artist Profiles: Local Noise Music

In the realm of contemporary music, noise has emerged as a unique and experimental genre that challenges conventional notions of sound production. Local noise music, specifically, showcases an array of artists who craft sonic landscapes through unconventional and often abrasive means. This article aims to delve into the world of local noise music by exploring …

Generating Revenue: Local Noise Music Events in the Context of Sound Finance

Noise music events have gained significant attention in recent years, both as a form of artistic expression and as potential revenue generators. This article explores the concept of generating revenue through local noise music events within the context of sound finance. Drawing upon real-world examples and hypothetical scenarios alike, it examines the various strategies that …

Amplifier Feedback and Local Noise Music: Techniques

Amplifier feedback and local noise music have gained significant attention in recent years due to their unconventional techniques, which challenge traditional notions of music composition and performance. This article aims to explore the various methods employed by musicians and sound artists to create unique sonic experiences through the manipulation of amplifier feedback and localized noise. …

Artist Profiles: Local Noise Music

In the realm of contemporary music, noise has emerged as a unique and experimental genre that challenges conventional notions of sound production. Local noise music, specifically, showcases an array of artists who craft sonic landscapes through unconventional and often abrasive means. This article aims to delve into the world of local noise music by exploring …

Guitar Pedals: Local Noise Music Equipment

Guitar pedals have become an essential component of the local noise music scene, offering musicians a wide range of creative possibilities to explore and experiment with. These small electronic devices are designed to alter the sound produced by electric guitars, allowing for the creation of unique and unconventional tones that define the distinctiveness of noise …

Noise Music in Japan: The Local Noise Music Scene and Festivals.

The noise music scene in Japan has gained significant attention and recognition over the years, both locally and internationally. With its unique blend of experimental soundscapes, unconventional instruments, and boundary-pushing performances, noise music has become a prominent subculture within the country’s vibrant music landscape. This article aims to delve into the intricacies of the Japanese …

Interviews: Local Noise Music Artist Profiles

In the realm of music, local noise artists often occupy a fascinating and enigmatic space. Their unconventional approach to sound creation challenges traditional notions of melody and structure, inviting listeners into an immersive sonic experience that pushes boundaries. This article aims to delve into the world of local noise music artist profiles through interviews, shedding …

Guitar Pedals: Local Noise Music Equipment

Guitar pedals have become an essential component of the local noise music scene, offering musicians a wide range of creative possibilities to explore and experiment with. These small electronic devices are designed to alter the sound produced by electric guitars, allowing for the creation of unique and unconventional tones that define the distinctiveness of noise …

Underground Noise Music Festivals: Local Noise Music

Underground noise music festivals have been gaining popularity in recent years, particularly within the realm of local noise music scenes. These unique events provide a platform for musicians and artists to showcase their avant-garde soundscapes while embracing unconventional approaches to musical expression. One notable example is the annual “Sonic Disruption” festival held in an abandoned …

Local Noise Music: Artist Profiles – Biographical Insights

Noise music is a genre that has gained significant attention in recent years, with its unique and unconventional approach to sound creation. Local noise musicians have played a pivotal role in shaping this genre by pushing the boundaries of traditional musical norms. This article aims to provide biographical insights into the lives and works of …

Sound Finance: Optimizing Local Noise Music for Financial Success

The world of noise music, characterized by its experimental and unconventional approach to sound production, has gained a significant following in recent years. While often perceived as a purely artistic endeavor, noise musicians are increasingly exploring the potential for financial success within this niche genre. This article aims to examine the concept of “sound finance” …

Contemporary Noise Music Artists: Local Noise Music and Festivals

Contemporary noise music artists have emerged as a significant force within the realm of experimental music, challenging conventional notions of musicality and pushing the boundaries of sonic exploration. This article focuses on local noise music scenes and festivals, examining their unique characteristics and contributions to the broader landscape of contemporary art. To illustrate these concepts, …

Modular Synthesizers for Local Noise Music: Essential Equipment Guide

Modular synthesizers have become an indispensable tool for musicians and sound artists in the realm of local noise music. With their versatility, flexibility, and seemingly infinite sonic possibilities, these complex systems offer a unique approach to creating unconventional and experimental sounds. This article serves as an essential equipment guide for those interested in exploring the …

Local Noise Music: The Vibrant World of Noise Music Festivals

Noise music, often deemed as an unconventional and avant-garde genre, has been gaining significant attention in recent years. Characterized by its deliberate use of dissonance, feedback, and distortion, noise music challenges traditional notions of melody and harmony to create a cacophonic yet captivating sonic experience. In this article, we delve into the vibrant world of …

Impact of Local Noise Music on Sound Finance: The Effects of Noise Pollution on the Local Economy

The impact of local noise music on sound finance is a subject that has garnered increasing attention in recent years. As cities and urban areas continue to grow, so does the prevalence of noise pollution resulting from various sources, including live music performances. This article aims to explore the effects of such noise pollution on …

Noise Music in Japan: The Local Noise Music Scene and Festivals.

The noise music scene in Japan has gained significant attention and recognition over the years, both locally and internationally. With its unique blend of experimental soundscapes, unconventional instruments, and boundary-pushing performances, noise music has become a prominent subculture within the country’s vibrant music landscape. This article aims to delve into the intricacies of the Japanese …

DIY Venues in Local Noise Music: An Informative Guide

In the realm of underground music scenes, noise music stands out as a genre that defies traditional musical conventions and embraces sonic experimentation. Within this subculture, DIY venues play a vital role in fostering creativity and providing platforms for artists to showcase their work. This article aims to provide an informative guide on DIY venues …

Granular Synthesis: Techniques for Local Noise Music

Granular synthesis is a versatile technique employed in the creation of local noise music. This article aims to explore and analyze various techniques utilized in granular synthesis for the production of compelling and immersive soundscapes. By breaking down audio samples into tiny, discrete fragments known as grains, granular synthesis allows composers and performers to manipulate …

Local Noise Music: Live Performances and Artist Profiles

Local noise music scenes have been gaining momentum and attracting attention in recent years. This unique genre of music, characterized by its unconventional use of sound, has captivated audiences with its experimental nature and immersive live performances. One such example is the thriving noise music scene in the city of Portland, Oregon. Through a case …

Circuit Bending: Local Noise Music Techniques

Circuit bending, a technique rooted in the realm of local noise music, has gained significant attention among musicians and enthusiasts alike. This practice involves manipulating electronic devices such as keyboards or toy synthesizers to produce unconventional sounds and textures. One captivating example of circuit bending is the case study of musician X, who transformed an …

Alternative Music Spaces: Local Noise Music Performance Venues

Alternative music spaces, often referred to as local noise music performance venues, have emerged as significant cultural phenomena in recent years. These unique spaces provide a platform for underground and experimental musicians to showcase their work to an audience seeking non-mainstream sounds and experiences. To illustrate the significance of these alternative music spaces, consider the …

Field Recordings in Local Noise Music: Techniques

Field recordings play a crucial role in the creation and exploration of local noise music. By capturing and manipulating sounds from various environments, artists are able to infuse their compositions with a distinct sense of place and context. This article delves into the techniques involved in utilizing field recordings within the realm of local noise …

Experimental Music Venues: Local Noise Music Performance Spaces

Experimental music venues have emerged as unique and dynamic spaces that foster the exploration and appreciation of noise music. These unconventional performance spaces provide a platform for musicians to push the boundaries of traditional musical expression, challenging conventional notions of melody, harmony, and rhythm. In this article, we will delve into the world of experimental …

Artist Profiles: Local Noise Music

In the realm of contemporary music, noise has emerged as a unique and experimental genre that challenges conventional notions of sound production. Local noise music, specifically, showcases an array of artists who craft sonic landscapes through unconventional and often abrasive means. This article aims to delve into the world of local noise music by exploring …

Field Recorders: Essential Equipment for Local Noise Music

Field recorders are an indispensable tool for local noise musicians, enabling them to capture and manipulate the rich sonic landscapes of their surroundings. By utilizing these devices, artists can explore the potential of everyday sounds, transforming mundane noises into aural expressions that challenge traditional notions of music composition. For instance, imagine a noise musician strolling …

Glitch Techniques: Local Noise Music

The field of music production has seen the emergence of various experimental techniques that challenge conventional notions of sound composition and arrangement. One such technique is glitch, a genre that embraces imperfections and errors within digital audio to create unique sonic experiences. Glitch music utilizes local noise as its primary building block, manipulating and distorting …

Loop Stations: Essential Equipment for Local Noise Music

Local noise music has gained significant popularity in recent years, captivating audiences with its experimental soundscapes and unconventional approach to musical composition. At the forefront of this movement lies an essential piece of equipment known as loop stations. Loop stations provide musicians with the ability to create complex layers of sound by recording and playing …

Local Noise Music: Artist Profiles – Biographical Insights

Noise music is a genre that has gained significant attention in recent years, with its unique and unconventional approach to sound creation. Local noise musicians have played a pivotal role in shaping this genre by pushing the boundaries of traditional musical norms. This article aims to provide biographical insights into the lives and works of …

Field Recorders: Essential Equipment for Local Noise Music

Field recorders are an indispensable tool for local noise musicians, enabling them to capture and manipulate the rich sonic landscapes of their surroundings. By utilizing these devices, artists can explore the potential of everyday sounds, transforming mundane noises into aural expressions that challenge traditional notions of music composition. For instance, imagine a noise musician strolling …

Modular Synthesizers for Local Noise Music: Essential Equipment Guide

Modular synthesizers have become an indispensable tool for musicians and sound artists in the realm of local noise music. With their versatility, flexibility, and seemingly infinite sonic possibilities, these complex systems offer a unique approach to creating unconventional and experimental sounds. This article serves as an essential equipment guide for those interested in exploring the …

Amplifier Feedback and Local Noise Music: Techniques

Amplifier feedback and local noise music have gained significant attention in recent years due to their unconventional techniques, which challenge traditional notions of music composition and performance. This article aims to explore the various methods employed by musicians and sound artists to create unique sonic experiences through the manipulation of amplifier feedback and localized noise. …

Local Noise Music: The Vibrant World of Noise Music Festivals

Noise music, often deemed as an unconventional and avant-garde genre, has been gaining significant attention in recent years. Characterized by its deliberate use of dissonance, feedback, and distortion, noise music challenges traditional notions of melody and harmony to create a cacophonic yet captivating sonic experience. In this article, we delve into the vibrant world of …

The Impact of Local Noise Music on Tourism: The Relationship in the Context of Sound Finance

In recent years, the emergence and popularity of local noise music have sparked a growing interest among researchers and policy-makers in understanding its impact on tourism. This article examines the relationship between local noise music and tourism from the perspective of sound finance. With an increasing number of travelers seeking unique cultural experiences, destinations that …

Effects Pedals: The Sonic Possibilities for Local Noise Music Equipment

Effects pedals have revolutionized the world of music, providing musicians with a plethora of sonic possibilities. These small devices are capable of transforming the sound produced by various musical instruments, allowing artists to create unique and experimental sounds. One such example is the case of a local noise musician who used effects pedals to enhance …

Independent Performance Spaces: Local Noise Music Venues

Independent performance spaces, particularly those dedicated to noise music, have emerged as vibrant and essential components of local cultural scenes worldwide. These unique venues provide a platform for experimental artists and musicians who wish to push the boundaries of conventional sound and challenge traditional notions of musicality. Through showcasing unconventional genres such as noise music, …

Avant-Garde Venues: Local Noise Music Performance Spaces

In the realm of underground music, avant-garde venues serve as vital spaces for the performance and appreciation of local noise music. These venues are characterized by their unconventional settings, experimental soundscapes, and a collective desire to challenge traditional notions of musicality. One such example is The Sonic Lab, a hypothetical venue located in a repurposed …

Amplifier Feedback and Local Noise Music: Techniques

Amplifier feedback and local noise music have gained significant attention in recent years due to their unconventional techniques, which challenge traditional notions of music composition and performance. This article aims to explore the various methods employed by musicians and sound artists to create unique sonic experiences through the manipulation of amplifier feedback and localized noise. …

2022’s top emergency loans for Bad Credit

A poor credit score could be a real threat to your worst financial position. If you fall into this category, you’re viewed as a risky individual to lend money to emergency Loans Consolidation now. In the end, you’re faced with a myriad of challenges to deal with, such as high-interest rates and security deposits, concise repayment terms, …